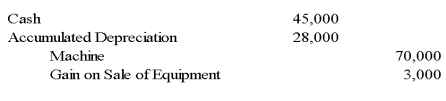

On January 1,2007,Servant Company purchased a machine with an expected economic life of five years.On January 1,2009,Servant sold the machine to Master Corporation and recorded the following entry:

Master Corporation holds 75 percent of Servant's voting shares.Servant reported net income of $50,000,and Master reported income from its own operations of $100,000 for 2009.There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

-Based on the preceding information,in the preparation of the 2009 consolidated balance sheet,machine will be:

Definitions:

Signaling Theory

A concept that suggests that individuals send signals about their qualities or intentions through their actions or investments, which others then interpret to make decisions.

Brand Names

The distinctive titles given to products or services by companies to identify and differentiate them from competitors' offerings.

Unsavory Taste

A negative or unpleasant flavor perceived during food consumption.

Blind Taste Test

A blind taste test is a method of evaluating food or drink products where the participants are unaware of the brands being tested to eliminate bias.

Q5: Toledo Imports,a calendar-year corporation,had the following income

Q19: FASB 131,Disclosure about Segments of an Enterprise

Q19: Based on the preceding information,what will be

Q23: Based on the information given above,what inventory

Q23: Burrough Corporation concluded that the fair value

Q24: Based on the preceding information,during 2008,Firewire will

Q32: Refer to the facts in Question 46.The

Q35: Based on the information provided,what would be

Q43: Based on the preceding information,the amount of

Q45: Refer to the above information.Which statement below