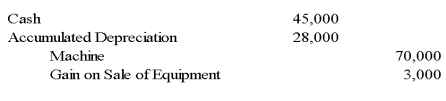

On January 1,2007,Servant Company purchased a machine with an expected economic life of five years.On January 1,2009,Servant sold the machine to Master Corporation and recorded the following entry:

Master Corporation holds 75 percent of Servant's voting shares.Servant reported net income of $50,000,and Master reported income from its own operations of $100,000 for 2009.There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

-Based on the preceding information,income assigned to the noncontrolling interest in the 2009 consolidated income statement will be:

Definitions:

Means-Ends Test

The means-ends test is a principle used in law and ethics to evaluate whether the methods used to achieve a goal are appropriately and directly connected to the intended outcomes.

Constitutional Right

Rights afforded to individuals by the constitution that are protected from governmental interference.

Due Process

The principle that an individual cannot be deprived of life, liberty, or property without appropriate legal procedures and safeguards.

Fifth Amendment

An amendment to the U.S. Constitution that provides several protections for individuals, including protection against self-incrimination and double jeopardy, and the Takings Clause.

Q7: Based on the preceding information,in the eliminating

Q13: Based on the preceding information,in the preparation

Q16: Which of the following best describes a

Q21: Based on the preceding information,what is the

Q24: Goodwill under the parent theory:<br>A)exceeds goodwill under

Q26: Which system helps the SEC accomplish its

Q36: Based on the preceding information,what amount will

Q41: Parisian Co.is a French company located in

Q54: Chicago based Corporation X has a number

Q116: Interpretive sociology is sociology that<br>A)focuses on action.<br>B)sees