Haskell,Inc.,reported the following income before income taxes,income taxes expense,and net income for 2009 and 2010:

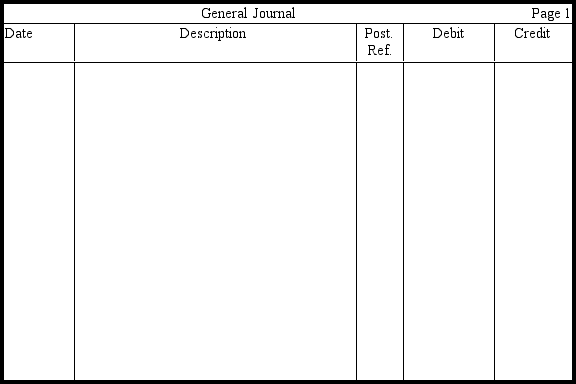

In 2009,Haskell deducted a $35,000 item for income tax purposes that was not deducted for accounting purposes until 2010.Haskell's marginal tax rate is 40 percent.Prepare entries in journal form without explanations to record Haskell's income taxes expense and income taxes payable for each year,assuming that income tax allocation procedures are used properly.

Definitions:

Tempo

The speed at which a piece of music is played or the pace of an activity or process.

Pitch

The quality of a sound governed by the rate of vibrations producing it; the highness or lowness of a tone.

Intonation

The rise and fall of the voice in speaking, which can affect the meaning of what is being said.

Chronological Pattern

Organizing content or events in the order they occurred over time, from the earliest to the most recent.

Q3: Neither the amount of detail nor the

Q4: Identify (by code letter)each of the following

Q8: Held-to-maturity securities are valued on the balance

Q12: Royer Corporation engaged in this transaction: Issued

Q23: In analyzing nonfinancial data,it is important to

Q48: The par value of stock constitutes the

Q67: On the lines below,provide the components for

Q104: The Assembly Department of KEIA employs three

Q136: Discuss the financial statement presentation of the

Q171: If bonds are retired by an issuer