Haskell,Inc.,reported the following income before income taxes,income taxes expense,and net income for 2009 and 2010:

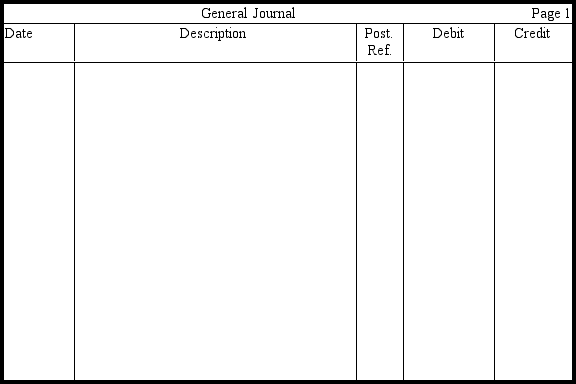

In 2009,Haskell deducted a $35,000 item for income tax purposes that was not deducted for accounting purposes until 2010.Haskell's marginal tax rate is 40 percent.Prepare entries in journal form without explanations to record Haskell's income taxes expense and income taxes payable for each year,assuming that income tax allocation procedures are used properly.

Definitions:

Reassure

To provide comfort or support to someone, often by assuring them that their concerns and fears are understood and will be addressed.

Cognitive-behavioral Therapy

A form of psychotherapy that emphasizes the role of thinking in how we feel and what we do, focusing on changing negative thought patterns and behaviors.

Self-defeating Thoughts

Negative and often irrational thoughts that impede one's success or well-being.

Maladaptive Behaviors

Behaviors that inhibit an individual's ability to adjust healthily to particular situations.

Q43: An extraordinary loss of $250,000 that results

Q44: If the amount of income taxes expense

Q55: Noncash investing and financing transactions<br>A) appear as

Q62: The balance scorecard<br>A) is rarely used.<br>B) produces

Q69: "Big baths" commonly occur when a company

Q74: Amortization expense is deducted from net income

Q87: A value chain includes only processes and

Q89: Indicate on the blanks below the effect

Q114: It is possible that an investor with

Q179: If bonds are issued at a premium,the