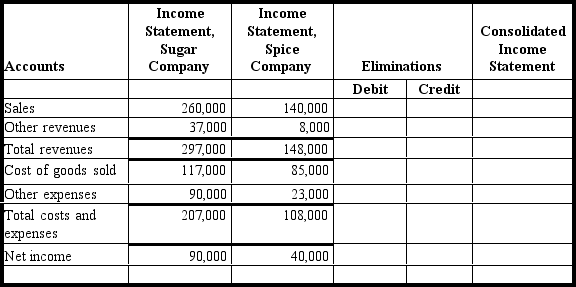

Sugar Company owns 100 percent of the stock of Spice Company.The separate income statements for the two companies for the year ended December 31,2010,are provided below.Sugar Company sold a product to Spice Company for $28,000,and Spice Company sold it to a customer for $40,000.Spice paid Sugar $3,000 interest on a loan from Sugar.Complete the work sheet by providing the amounts for the Eliminations columns and the Consolidated Income Statement column.

Definitions:

High Delivery Costs

Expenses associated with transporting products from the manufacturer or seller to the consumer, which are significant compared to the overall cost or value of the product.

Banner Blindness

The phenomenon where website users consciously or unconsciously ignore banner-like information, usually ads, on websites.

Click-Through Rate

A metric that measures the percentage of clicks advertisers receive on their ads per number of impressions.

Internet Searches

The process of using a search engine on the internet to find specific information, websites, or content based on keyword queries.

Q16: Which of the following could be described

Q38: Royer Corporation engaged in this transaction: Repaid

Q61: When disposing of equipment,the Equipment account is

Q76: Which of the following would have the

Q82: In preparing a statement of cash flows

Q90: A corporation often uses an underwriter for

Q106: For an item to be treated as

Q141: A liquidating dividend is<br>A) a dividend that

Q157: When bonds are converted to common stock,what

Q172: A small stock dividend should be recorded