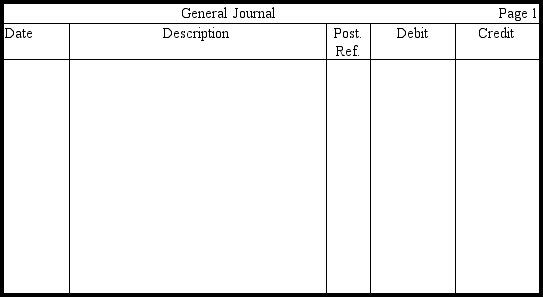

Darla Katz earns an hourly wage of $12,with time-and-a-half pay for hours worked over 40 per week.During the most recent week,she worked 46 hours,her federal tax withholding totaled $62,her state tax withholding totaled $18,and $3 was withheld for union dues.Assuming a 6.2 percent social security tax rate and a 1.45 percent Medicare tax rate,prepare the entry without explanation in the journal provided to record Katz's wages and related liabilities.Round to the nearest penny.

Definitions:

Paid in Surplus

The amount of money paid to a company by investors in exchange for stock, beyond the par value of the stock.

Par Value

The face value of a bond or stock, as determined at the time of issuance.

Reverse Stock Split

A reverse stock split is an action taken by a corporation to reduce the number of its current shares in the market, thereby increasing the share price.

Market Price

The current price at which an asset or service can be bought or sold in a competitive and open market.

Q27: The product warranty liability is an example

Q39: When the allowance method is used,the write-off

Q61: A contingent liability is best described as

Q78: One might infer from a debit balance

Q87: A debit to Accumulated Depreciation will increase

Q96: Inventory is classified as a long-term asset.

Q105: An overstatement of ending inventory in one

Q107: A $200,000 bond issue with a

Q143: Lee Provo is paid $8 per hour,plus

Q152: The costs included in work in process