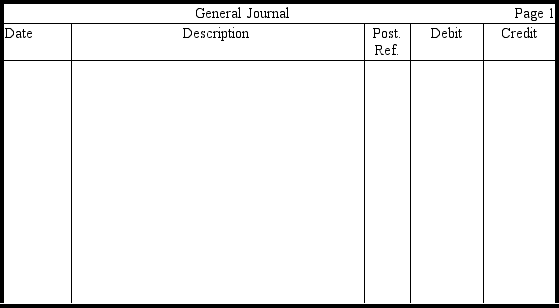

In the journal provided,prepare entries for the following (assume a calendar-year accounting period): Omit explanations.

Dec. 1Received a three-month, 15 percent note receivable for from a customer as an extension of his past-due account.

31 Made the year-end adjustment for accrued interest.

Mar. 1Received full payment on the note.

Definitions:

Ending Inventory

The total value of goods available for sale at the end of an accounting period, calculated by adding purchases to beginning inventory and then subtracting the cost of goods sold.

LIFO Perpetual Cost Flow

A method of inventory valuation where the last items added to inventory are the first ones considered sold under a perpetual inventory tracking system.

Ending Inventory

Ending inventory refers to the final value or quantity of goods available for sale at the end of an accounting period, after adjustments for sales and acquisitions during the period.

Cost Of Merchandise Sold

The total cost incurred to purchase or produce the goods that a company sold during a specific period.

Q6: Commercial paper normally is issued by companies

Q76: Illegal acts of a small dollar amount

Q87: In periods of rising prices,the FIFO method

Q88: The single-step and multistep income statements result

Q99: The relevance of accounting information is also

Q114: All of the following are measures of

Q123: Use this balance sheet and income

Q133: Use this inventory information for the

Q145: Both the retail method and the gross

Q161: Current liabilities are classified as either definitely