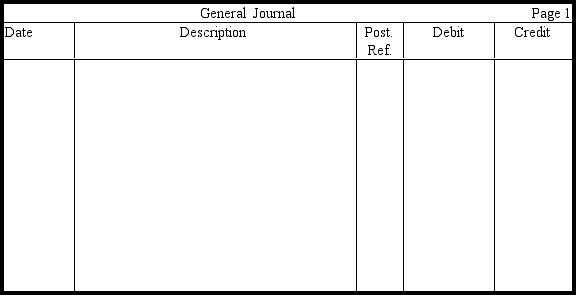

Assuming that the allowance method is being used,prepare journal entries to record the following transactions.Omit explanations.

Mar. 15 Sold merchandise to Faust for on account.

Apr. 15 Received from Faust.

Aug. 15 Wrote off Faust's account as uncollectible.

Nov. 15 Unexpectedly received payment in full from Faust.

Definitions:

Record Depreciation Expense

The process of allocating the cost of a tangible asset over its useful life, reflecting wear and tear or obsolescence.

Allocate Prepaid Insurance

involves distributing the cost of insurance premiums over the period that the insurance coverage relates to, recognizing it as an expense over time rather than all at once.

Accrue Salaries Payable

Accrue Salaries Payable involves recording the salaries earned by employees that have not yet been paid, recognizing the liability before the cash is disbursed.

Q9: A contingent liability is not entered into

Q18: Which of the following costs normally is

Q66: The account Allowance for Uncollectible Accounts is

Q91: A revenue expenditure results in a<br>A) debit

Q105: Why is the separation of duties an

Q109: All factors in a present value of

Q120: Which of the following attributes of internal

Q139: On a bank reconciliation,a bank service charge

Q143: Lee Provo is paid $8 per hour,plus

Q149: Use this information to answer the