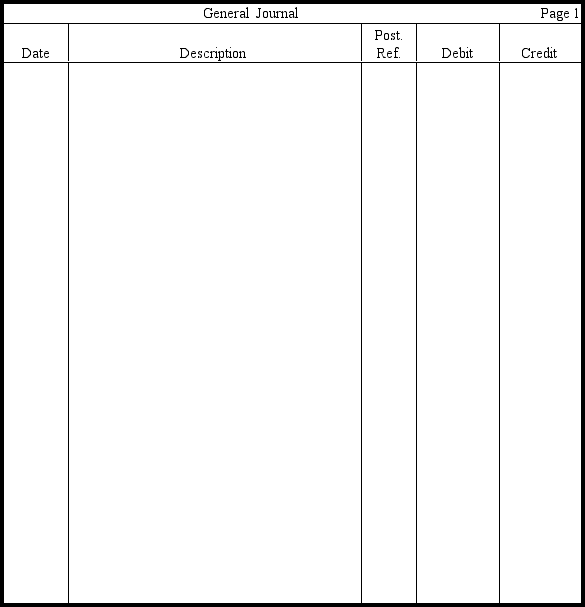

Prepare journal entries without explanations for the merchandising transactions listed below for Naveh Corporation.Assume use of the periodic inventory system.

Definitions:

Contribution Margin

The contribution margin represents the difference between a company's sales revenue and its variable costs. It is used to assess how much revenue contributes to covering fixed costs and generating profit.

Break-Even Analysis

An economic computation identifying the moment when income matches the expenses involved in generating that income.

Profit Goal

A financial objective set by a business or organization aiming to achieve a specific amount of profit over a certain period.

MBO Cycle

Management by Objectives (MBO) Cycle refers to the systematic process of defining objectives within an organization so that management and employees agree to the objectives and understand what they need to do in the organization.

Q8: Which of the following sequences of actions

Q15: The work sheet is prepared<br>A) after the

Q18: A purchase on account with an invoice

Q29: Which of the following is not an

Q36: Assume that the $5,509 sales made by

Q51: The process of crossfooting on the work

Q93: A company with a current ratio of

Q109: The following lettered items represent a classification

Q118: Which of the following is an inventory

Q174: Which of the following would not be