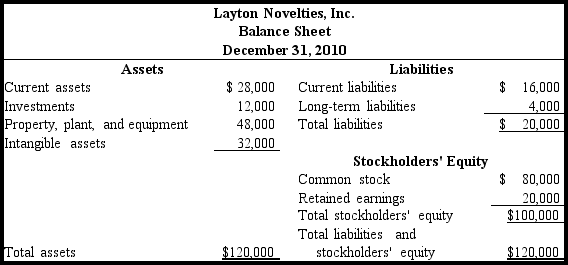

Use this balance sheet and income statement for the first year of operations for Layton Novelties,Inc.to answer the following question.Use ending balances whenever average balances are required for computing ratios.

The return on assets for Layton Novelties is

The return on assets for Layton Novelties is

Definitions:

Interest Rates

The proportion of a loan that is charged as interest to the borrower, typically expressed as an annual percentage of the loan outstanding.

Interest-Sensitive Goods

These are goods whose demand fluctuates in response to changes in interest rates, often because they involve large financial investments or credit to purchase.

Financial Crisis

A situation where financial assets suddenly lose a significant part of their nominal value, often leading to bankruptcies and economic downturns.

Regulatory Changes

Modifications or updates in laws and regulations that affect how businesses operate and compete.

Q11: Generally,before Accounts Payable is debited,it is credited.

Q13: The classification issue involves the assignment of

Q21: In a purchase system,the most appropriate department

Q24: Accumulated depreciation is classified as a(n)<br>A) contra-expense

Q70: Prepare year-end adjusting entries for each of

Q92: When the average-cost method is applied to

Q121: Goods totaling $28,000 purchased February 2 on

Q125: When the terms of sale include a

Q132: Given equal circumstances,which inventory method probably would

Q135: Use this information to answer the