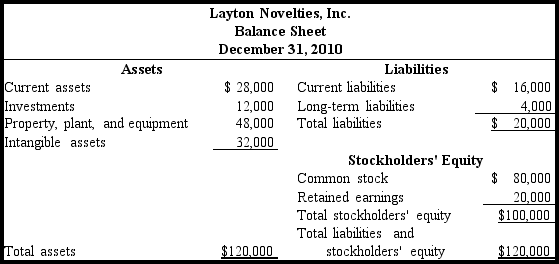

Use this balance sheet and income statement for the first year of operations for Layton Novelties,Inc.to answer the following question.Use ending balances whenever average balances are required for computing ratios.

The return on equity for Layton Novelties is

The return on equity for Layton Novelties is

Definitions:

Unit Investment Trust

An investment company that offers a fixed portfolio of securities in a one-time public offering, and is structured to provide a specific investment objective.

Net Asset Value

The total value of a fund's assets minus its liabilities, often used to calculate the price of a share in a mutual fund or an ETF.

Open Market

A market where goods, services, and financial instruments are traded freely, with prices determined by supply and demand.

Net Asset Value

The total value of a fund's assets minus its liabilities, often used in the context of mutual funds to determine each share's price.

Q21: Use this information to answer the

Q23: Which of the following does not include

Q23: The Land and Building accounts may be

Q28: Use this information to answer the

Q72: One might see "J2" correctly placed in

Q86: The lower-of-cost-or-market rule implies that it is

Q120: Which of the following is a condition

Q144: Which pair of accounts follows the rules

Q204: Which of the following transactions will not

Q224: Which of the following accounts most likely