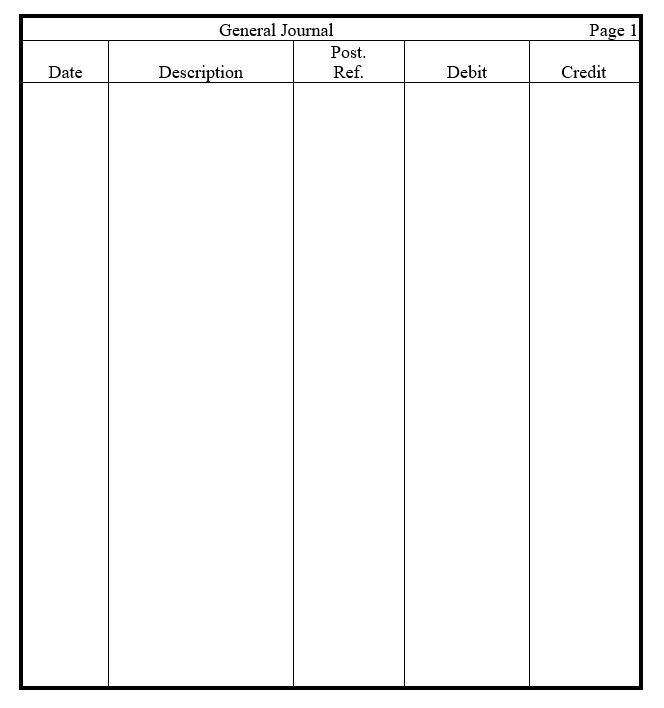

Prepare year-end adjusting entries for each of the following situations:

a. The Store Supplies account showed a beginning debit balance of $400 and purchases of $2,800. The ending debit balance was $800.

b. Depreciation on buildings is estimated to be $7,300.

c. A one-year insurance policy was purchased for $2,400. Nine months have passed since the purchase.

d. Accrued interest on notes payable amounted to $200.

e. The company received a $9,600 advance payment during the year on services to be performed. By the end of the year, one-third of the services had been performed.

f. Payroll for the five-day workweek, to be paid on Friday, is $10,000. The last day of the period is a Tuesday.

g. Services totaling $920 had been performed but not yet billed or recorded.

Definitions:

Social Cognitive Career Theory

A theory that focuses on how individuals' beliefs in their own capabilities affect their career paths, choices, and performance.

Barriers

Obstacles or impediments that hinder progress or prevent the achievement of a goal.

Career Choices

The decisions individuals make about their professional paths, including the selection of jobs and careers based on various factors.

Counseling Model

A theoretical framework that guides counselors in the process of understanding clients' issues and suggesting methods for improvement or resolution.

Q15: Which of the following could not possibly

Q70: Prepare year-end adjusting entries for each of

Q78: The going concern assumption helps solve the<br>A)

Q107: Assets are converted to revenues as they

Q119: In the space below,state whether each situation

Q137: Accounts Receivable and Accounts Payable are used

Q161: Both return on assets and working capital

Q164: Use this information pertaining to the

Q167: The intentional preparation of misleading financial statements,known

Q206: Adjusting entries are useful in apportioning costs