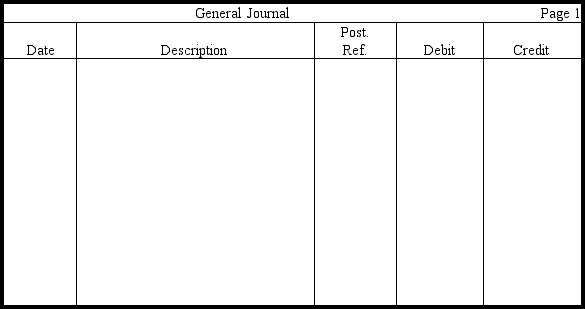

Below Are the Adjusted Accounts of Slate Realtors,Inc In the Journal Provided,prepare Slate's Closing Entries (Omit Explanations)

Below are the adjusted accounts of Slate Realtors,Inc.,for the month ended Oct.31,2010,listed in alphabetical order:

In the journal provided,prepare Slate's closing entries (omit explanations).

Definitions:

Logical Factors

Elements or considerations that are based on clear, sound reasoning or the formal laws of logic.

Emotional Factors

Elements that influence feelings, mood, and emotional states, affecting behavior and decision-making.

Truth

The quality or state of being true, in accordance with fact or reality.

Falsehood

A statement or belief that is untrue or deceptive.

Q8: Sandy's Supply Store,Inc.,entered into the transactions listed

Q47: In a trial balance,all debits are listed

Q72: Manuel Banales,Marketing Director of Plano Power Plants,Inc.'s

Q78: The going concern assumption helps solve the<br>A)

Q127: General-purpose external financial statements that are divided

Q143: The recognition issue deals with when a

Q150: Which of the following documents is sent

Q161: An important purpose of closing entries is

Q168: Use this adjusted trial balance to

Q171: Which of the following statements is not