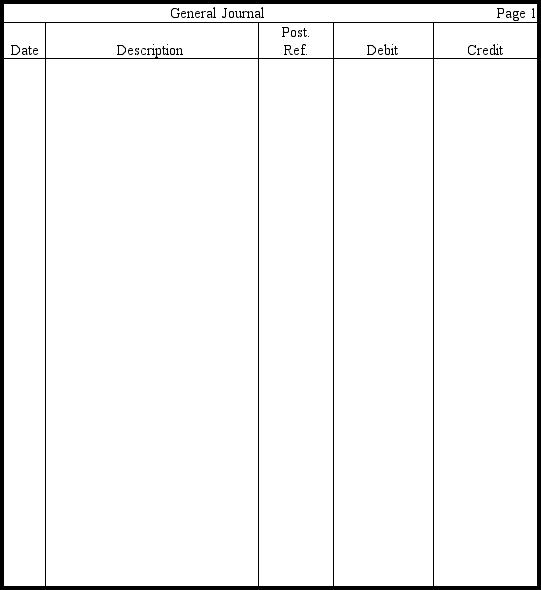

In the journal provided,prepare journal entries (in good form)for the following transactions.If no entry is required,write "no entry." Omit explanations.

Apr. 1 Investors opened a dry cleaning service, called Same Day Cleaners, by depositing into a business bank account and receiving 60,000 shares of par value stock in exchange.

3 Paid two years' rent in advance, .

6 Purchased dry cleaning equipment for . Paid in cash, the remainder to be paid in two weeks.

9 Hired a part-time worker, to be paid per week, starting tomorrow.

17 Paid the worker's weekly wage.

17 Recorded cash received for services performed during the week, .

20 Paid for the remainder of the equipment purchased on April 6.

21 Received in advance of cleaning and boxing a wedding gown.

23 Performed of dry cleaning services for Asa's Tuxedo Shop. It will remit payment in three days.

24 Paid the weekly wages.

26 Received payment from Asa's Tuxedo Shop.

30 Received a telephone bill for , which will be paid in two weeks.

Definitions:

Cerebral Cortex

The outer layer of the brain that is responsible for complex cognitive processes, including thought, memory, awareness, and consciousness.

Biological Evolution

The process by which different kinds of living organisms are thought to have developed and diversified from earlier forms during the history of the earth.

Low Base Rate Fallacy

The tendency to ignore the base rate (i.e., the prevalence of an event or characteristic within a given population) when making judgments of probabilities, leading to inaccurate assessments.

Rarely Exercised Option

An option or choice that is available but seldom used or selected by people.

Q5: Use the following accounts and information

Q6: The work sheet should be prepared after

Q10: A market research firm is investigating the

Q30: Meagan Dubean manages a portfolio of

Q33: The amount for Dividends will appear in

Q46: Net income is another term for revenues.

Q50: Bill Pierce owns several ice cream shops

Q68: A company recorded office supplies in an

Q122: All of the following are examples of

Q219: The cash basis of accounting is prohibited