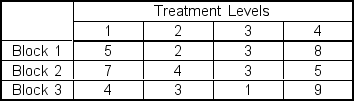

Data from a randomized block design are shown in the following table:

Using = 0.05,the observed F value for the treatments null hypothesis is ___.

Definitions:

Portfolio Standard Deviation

A statistical measure of the volatility of returns from a portfolio of assets, indicating the degree of investment risk.

Covariances

A measure that indicates the extent to which two variables change together, determining the degree of their correlation.

Expected Return

The weighted average of all possible returns for an investment, with weights being the probabilities of each outcome.

Standard Deviation

A statistical measure of the dispersion of returns for a given security or market index, indicating how much returns can deviate from the average return.

Q9: A multiple regression analysis produced the

Q10: Pinky Bauer,Chief Financial Officer of Harrison Haulers,Inc.

Q20: A multiple regression analysis produced the following

Q27: Collinsville Construction Company purchases steel rods

Q36: If x,the time (in minutes)to complete

Q40: Consider the following null and alternative

Q41: A researcher is interested in testing to

Q51: The following ANOVA table is from a

Q60: The forecast value for August was

Q73: Which of the following tests should be