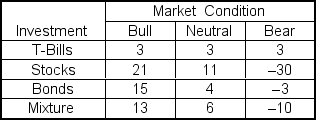

Ray Crofford is evaluating investment alternatives to invest $100,000 which he inherited from his grandfather.His investment advisor has identified four alternatives and constructed the following payoff table which shows expected profits (in $10,000's) for various market conditions:  For the 'Stocks' and 'Bonds' choices,the indifference value of Hurwicz's alpha is ___.

For the 'Stocks' and 'Bonds' choices,the indifference value of Hurwicz's alpha is ___.

Definitions:

NPV

The calculation of the current value of all future cash flows generated by a project, after accounting for the initial capital expenditure.

IRR

Internal Rate of Return; a metric used in capital budgeting to estimate the profitability of potential investments.

Probability Distributions

A statistical function that describes all the possible values and likelihoods that a random variable can take within a given range.

Portfolio Theory

A body of thought aimed at forming investment portfolios that minimize risk for a given return.

Q26: Service facilities must be physically located close

Q29: The focus of pre-production services is on

Q31: In the Friedman test of c treatment

Q38: Which of the following is not true

Q40: Discuss the role of technology on productivity.

Q54: Families of goods or services having similar

Q61: Assume the specifications for a part

Q75: A variable contains five categories.It is

Q75: Charles Clayton monitors the daily performance of

Q78: Make decisions under uncertainty using the maximax