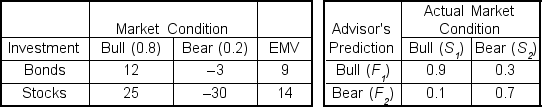

Ray Crofford is evaluating investment alternatives for the $100,000 which he inherited from his grandfather.His investment advisor has identified two alternatives and constructed the following tables which show (1) expected profits (in $10,000's) for various market conditions and their probabilities,and (2) the advisor's track record on predicting Bull and Bear markets:  If the advisor predicts a Bull market the EMV of the Stocks alternative,using revised probabilities,is ___.

If the advisor predicts a Bull market the EMV of the Stocks alternative,using revised probabilities,is ___.

Definitions:

Annual Return

The percentage change in value of an investment over a one-year period, accounting for any dividends or interest earned.

Yearly Contribution

The amount of money contributed to an investment or savings account on an annual basis.

Traditional Retirement Plan

A tax-deferred retirement savings account where contributions may lower current taxable income and earnings grow tax-free until withdrawn.

Roth Retirement Plan

A type of retirement savings plan where contributions are made with after-tax dollars, and qualified withdrawals in the future are tax-free.

Q5: The nonparametric counterpart of the t test

Q13: A service encounter design focuses on the

Q24: Use of a smoothing constant value less

Q26: Generalize linear regression models as polynomial regression

Q37: Eventually, order qualifiers become order winners.

Q42: A multiple regression analysis produced the following

Q49: _ involves computer control of a manufacturing

Q54: A collection of strategies,techniques,and actions taken by

Q60: Which of the following would not be

Q63: Today, almost half the U.S.economy is involved