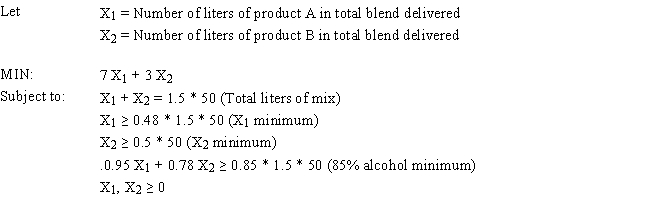

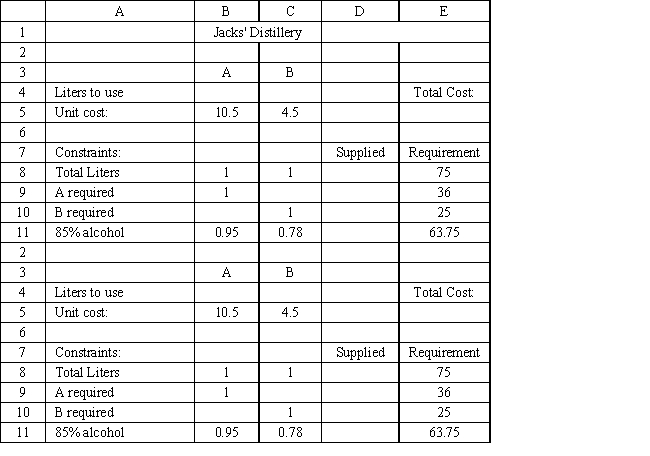

Exhibit 3.3

The following questions are based on this problem and accompanying Excel windows.

Jack's distillery blends scotches for local bars and saloons. One of his customers has requested a special blend of scotch targeted as a bar scotch. The customer wants the blend to involve two scotch products, call them A and B. Product A is a higher quality scotch while product B is a cheaper brand. The customer wants to make the claim the blend is closer to high quality than the alternative. The customer wants 50 1500 ml bottles of the blend. Each bottle must contain at least 48% of Product A and at least 500 ml of B. The customer also specified that the blend have an alcohol content of at least 85%. Product A contains 95% alcohol while product B contains 78%. The blend is sold for $12.50 per bottle. Product A costs $7 per liter and product B costs $3 per liter. The company wants to determine the blend that will meet the customer's requirements and maximize profit.

-Refer to Exhibit 3.3. What formula should be entered in cell E5 in the accompanying Excel spreadsheet to compute total cost?

Definitions:

Standard Deviation

A measure of the amount of variation or dispersion of a set of values; used in finance to quantify the risk associated with a security's return.

Market Risk

The risk of losses in investments attributable to market-wide phenomena, such as economic changes or interest rate fluctuations.

Beta

An indicator of how much a stock's price movement deviates from the general market, where a beta greater than 1 signifies more volatility than the overall market.

Required Return

The minimum rate of return on an investment that investors expect or require, taking into account the risk level of the investment.

Q6: Deviational variables<br>A)are added to constraints to indicate

Q8: All of the following affect secrecy and

Q24: Residuals are assumed to be<br>A)dependent,uniformly distributed random

Q30: One major advantage of goal programming GP)is

Q34: Swiss accounting is among the most transparent

Q40: Solve this problem graphically.What is the optimal

Q42: Social responsibility information<br>A) focuses on accountability to

Q54: Consider the following linear programming model and

Q64: Which step of the problem-solving process is

Q70: When a solution is degenerate the reduced