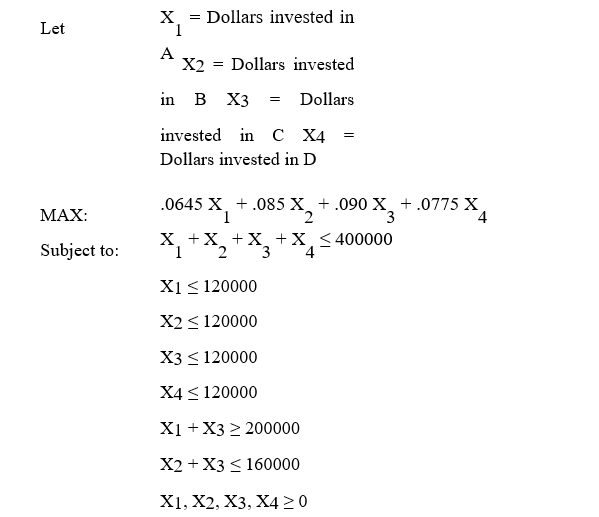

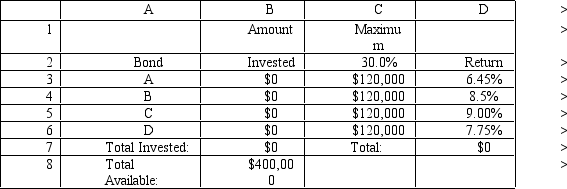

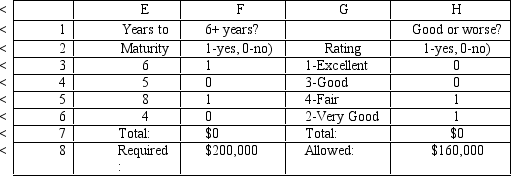

A financial planner wants to design a portfolio of investments for a client.The client has $400,000 to invest and the planner has identified four investment options for the money.The following requirements have been placed on the planner.No more than 30% of the money in any one investment,at least one half should be invested in long-term bonds which mature in six or more years,and no more than 40% of the total money should be invested in B or C since they are riskier investments.The planner has developed the following LP model based on the data in this table and the requirements of the client.The objective is to maximize the total return of the portfolio.

What formulas are required for the following cells in the Excel spreadsheet implementation of the formulation? B7

D7 F7 H7

Definitions:

Young Adulthood

A developmental stage typically referring to individuals aged between 18 to 40 years, characterized by exploration of personal and professional identities.

Cognitive Development

The growth and change in intellectual capacities, such as thinking, reasoning, and understanding, throughout the lifespan.

Language Development

The process by which humans acquire the capacity to perceive, produce, and use words to understand and communicate.

Perceptual Development

The gradual growth of a person's ability to interpret and make sense of sensory input from the environment, including sights, sounds, tastes, smells, and touch.

Q25: Weak uncertainty avoidance as a cultural value

Q28: In solving the NLP problem,Solver found a

Q35: The optimal solution to a NLP problem

Q37: What is the value of the slack

Q38: Refer to Exhibit 3.2.Which cells should be

Q41: Why does Switzerland have one of the

Q55: The company would like to build a

Q61: The main difference between linear LP)and nonlinear

Q66: Project 5.2 ? Small Production Planning

Q68: A company will be able to obtain