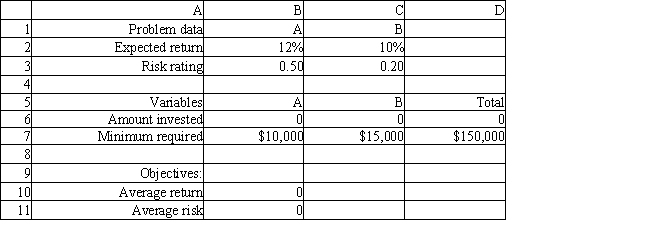

Exhibit 7.2

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B. Investment A requires a $10,000 minimum investment, pays a return of 12% and has a risk factor of .50. Investment B requires a $15,000 minimum investment, pays a return of 10% and has a risk factor of .20. The investor wants to maximize the return while minimizing the risk of the portfolio. The following multi-objective linear programming (MOLP) has been solved in Excel.

-Refer to Exhibit 7.2. What Analytic Solver Platform constraint involves cells $B$6:$C$6?

Definitions:

Market Imperfections

Occur when conditions for perfect market competition are not met, leading to inefficiencies such as monopolies or information asymmetries.

Stock Dividend

A dividend payment made in the form of additional shares rather than a cash payout, to shareholders.

Dividend

A portion of a company's earnings distributed to its shareholders, typically in the form of cash payments or additional shares.

Dividend Cuts

A reduction in the dividend payments issued by a company, which can signify financial distress or a reallocation of funds.

Q3: The terms b<sub>0</sub><sub> </sub>and b<sub>1</sub><sub> </sub>are referred

Q6: The global optimum solution to a nonlinear

Q34: Inventory position is defined as<br>A)ending inventory +

Q38: Refer to Exhibit 10.1.What percentage of the

Q40: The Reduced Gradient is similar to which

Q53: Refer to Exhibit 11.12.What are predicted sales

Q58: Goal programming differs from linear programming or

Q64: Which formula should be used to determine

Q69: What is the goal in optimization?<br>A)Find the

Q80: For a Poisson random variable,λ represents the