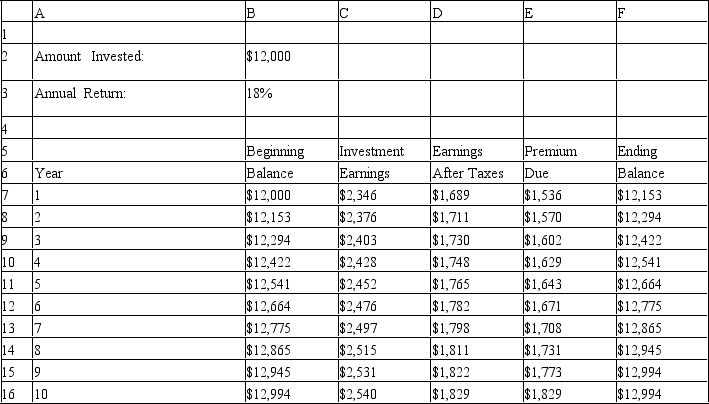

An investor wants to determine how much interest he must earn to be able to make the payments on a 10-year mortgage which has increasing annual payments.The problem is summarized in the accompanying spreadsheet.The investor has enough money to make an initial investment of $12,000 and hopes he can earn 18% on his investments.He would like to know how low his annual return can be and still allow him to make his payments from interest income.

If the Analytic Solver Platform is used,which are the Objective,Variables and Constraint cells in the spreadsheet for this problem?

Definitions:

Geothermal Energy

Heat energy generated and stored within the Earth, harnessed by humans for heating and generating electricity with minimal environmental impact.

Molten Rock

Liquid rock material formed under the earth's surface at extremely high temperatures, known as magma, or on the surface as lava from a volcanic eruption.

Methanol

Methanol, also known as methyl alcohol, is a chemical compound used as a solvent, antifreeze, fuel, and as a denaturant for ethanol. It is toxic to ingest.

Ethanol

A biofuel derived from corn, sugarcane, or other plant materials, used as an alternative to gasoline.

Q24: Residuals are assumed to be<br>A)dependent,uniformly distributed random

Q24: Using the information in Exhibit 12.4,what formula

Q26: A company wants to purchase large and

Q42: A practical way of dealing with the

Q56: NLP problems which have slack in all

Q59: Standardization of a variable<br>A)removes the scale factor

Q59: A sub-problem in a B & B

Q60: The d<sup>+</sup><br>Variable indicates the amount by which

Q74: Suppose that a data set contains a

Q106: A fast food restaurant is considering opening