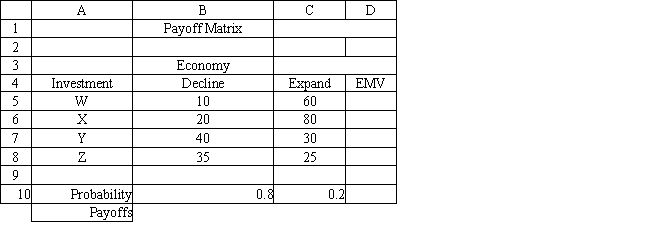

Exhibit 14.10

The following questions are based on the information below.

An investor is considering 4 investments, W, X, Y, and Z. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following payoff matrix has been developed for the decision problem. The investor has estimated the probability of a declining economy at 80% and an expanding economy at 20%.

-Refer to Exhibit 14.10. Complete the Regret Table according to the expected regret decision rule.

Definitions:

Net Present Value (NPV)

NPV is a financial metric used in capital budgeting to assess the profitability of an investment or project, calculated as the difference between the present value of cash inflows and outflows.

Capital Budgeting

The process by which investors or company management evaluate and select long-term investments that are likely to yield positive returns.

Long-Term Effects

The lasting outcomes or impacts that result from a specific action or event, considered over an extended period of time.

Short-Duration

Describes investments or financial instruments that have a short time until maturity, typically less than one year.

Q2: Refer to Exhibit 13.4.Based on this report

Q7: A bond that makes a regular interest

Q16: Refer to Exhibit 14.5.How high can PE)go

Q35: Using the information in Exhibit 12.3,what formula

Q39: Refer to Exhibit 9.5.Predict the mean value

Q46: A stock which was bought for $1,000

Q48: Discounting is the process of dividing a

Q58: Credit cards are<br>A)not counted as money because

Q61: Why did M1 grow so rapidly in

Q80: Refer to Exhibit 11.5.What formula should be