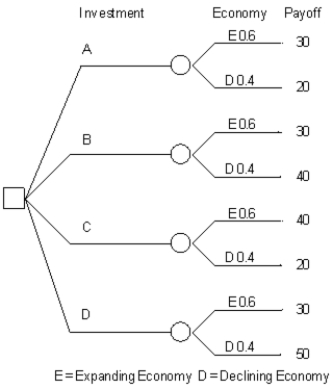

Exhibit 14.5

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C, D. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following decision tree has been developed for the problem. The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

-In decision-making, luck

Definitions:

Marketing Mix

The strategic combination of the four Ps—product, price, place, and promotion—used to market a product or service effectively.

Market Share

The percentage of an industry's sales that a particular company controls.

Ancillary Sales

Additional revenue generated from goods or services that complement a company's main business operations.

Customer Loyalty

The tendency of consumers to continue buying from the same brand or company, often due to satisfaction, convenience, or perceived value.

Q2: Suppose that a risk-neutral investor has a

Q19: The difference between expected payoff under certainty

Q26: Another name for the realized real interest

Q30: Based on the radar chart of raw

Q31: When people keep money for some period

Q56: Refer to Exhibit 15.3.Manually determine the earliest

Q67: Refer to Exhibit 9.1.What is the

Q77: Refer to Exhibit 10.1.What is the quantitative

Q94: In the k nearest neighbor technique,a small

Q107: Which of the following will be included