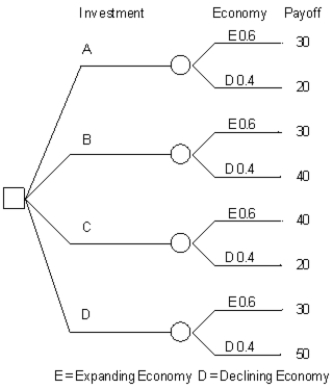

Exhibit 14.5

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C, D. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following decision tree has been developed for the problem. The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

-Decision models are applicable when

Definitions:

Profit Margin

A financial performance ratio that shows the percentage of profit a company makes for each dollar of revenue.

Return on Assets

A profitability ratio that indicates how efficiently a company is using its assets to generate profit.

Return on Equity

An indicator of a company's financial performance that shows the amount of profit generated per dollar of shareholders' investment.

Profitability Index

A financial metric that measures the relationship between the present value of future cash flows and the initial investment.

Q2: Refer to Exhibit 13.4.Based on this report

Q7: Suppose that the regrets for an alternative

Q8: Refer to Exhibit 14.2.What formula should go

Q9: If the nominal interest rate was 4

Q24: An investor is considering 2 investments,A,B,which can

Q32: Which of the following functions of money

Q49: Two approaches to clustering discussed in the

Q56: A doctor's office only has 8 chairs.The

Q64: Refer to Exhibit 9.2.What is the

Q71: Refer to Exhibit 11.8.What formula should be