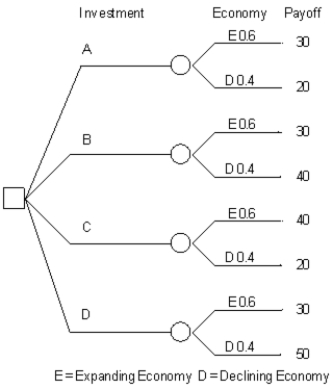

Exhibit 14.5

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C, D. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following decision tree has been developed for the problem. The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

-Suppose that the payoffs for an alternative with three states of nature are: 10, 20, and 30. The probabilities of these states of nature are 0.2, 0.3, and 0.5, respectively. The expected payoff for the alternative is equal to

Definitions:

Sunk Cost

Costs that have already been incurred and cannot be recovered or reversed.

Incremental Overhead Costs

Additional overhead expenses directly resulting from a specific business decision or activity.

Relevant Costs

Costs that should be considered when making decisions because they will be affected by the decision.

Markup Percentage

The percentage difference between the cost of a good or service and its selling price, indicating the gross profit margin.

Q21: An activity<br>A)is an effort required to complete

Q26: A stock's price is $100 at the

Q30: Which of the following statements is true?<br>A)A

Q38: The number of arrivals to a store

Q39: An investor calculating the standard deviation of

Q41: Refer to Exhibit 14.13.What formula should go

Q68: A contract that makes the owner of

Q73: Refer to Exhibit 11.10.What Excel command can

Q75: A circular node in a decision tree

Q96: Refer to Exhibit 10.2.What is the quantitative