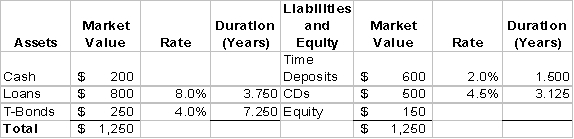

Use the following bank information for questions

-What is the bank's weighted average cost of liabilities?

Definitions:

Investment Project

A project requiring capital investment, aiming to generate financial returns or benefits in the future.

Cash Operating

Refers to the activities that involve the cash inflows and outflows from a company's primary business operations.

Salvage Value

The anticipated amount an asset is expected to yield when it is sold after its lifespan has concluded.

Depreciation

The process of allocating the cost of a tangible asset over its useful life, reflecting the decrease in value over time.

Q1: Which of the following is not one

Q2: Which financial ratio measures a firm's ability

Q4: Today, many banks target individuals as the

Q5: What is Dylan's cash flow from operations?<br>A)-$2,874,000<br>B)$8,126,000<br>C)$12,210,000<br>D)$19,126,000<br>E)$23,210,000

Q21: The expense ratio is calculated as:<br>A)total revenue

Q24: Prior to the Basle Agreement, primary capital

Q44: In regards to repurchase agreements, the margin

Q46: When loan demand is weak, a bank

Q48: Which of the following is primarily used

Q50: Many insurance companies have formed _ to