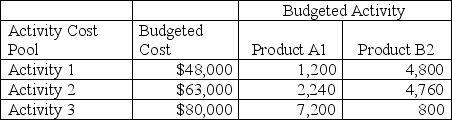

A company has two products: A1 and B2.It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools:

Annual production and sales level of Product A1 is 8,480 units,and the annual production and sales level of Product B2 is 22,310 units.What is the approximate overhead cost per unit of Product B2 under activity-based costing?

Definitions:

Budgeted Sales

Projected or estimated sales for a future period, usually based on past sales data, market analysis, and growth projections.

Master Budget

A comprehensive financial plan for a company's future operations, including multiple subsidiary budgets.

Selling Expense

Expenses directly associated with the sale of a product or service, including advertising, sales commissions, and promotional materials.

Credit Sales

Sales made on credit, where the customer agrees to pay at a future date.

Q3: Sindler Corporation sold 3,000 units of its

Q50: What is a scatter diagram? How is

Q52: A company has two products: Big and

Q64: Identify items (a),(b),and (c)in the cost-volume-profit chart

Q79: The high-low method is used to derive

Q84: The amount by which the overhead applied

Q145: Overapplied overhead is the amount by which

Q176: A company has two products: A1 and

Q178: The difference between sales price per unit

Q187: One difference between financial and managerial accounting