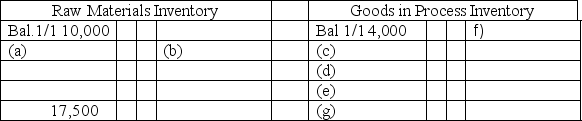

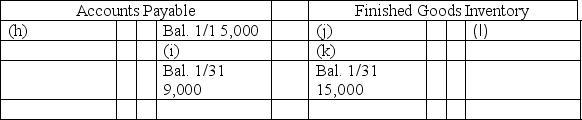

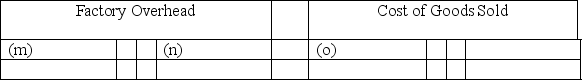

Medlar Corp.maintains a Web-based general ledger.Overhead is applied on the basis of direct labor costs.Its bookkeeper accidentally deleted most of the entries that had been recorded for January.A printout of the general ledger (in T-account form)showed the following:

A review of the prior year's financial statements,the current year's budget,and January's source documents produced the following information:

(1) Accounts Payable are used for raw material purchases only.January purchases were $49,000.

(2) Factory overhead costs for January were $17,000 none of which is indirect materials.

(3) The January 1 balance for finished goods inventory was $10,000.

(4) There was a single job in process at January 31 with a cost of $2,000 for direct materials and $1,500 for direct labor.

(5) Total cost of goods manufactured for January was $90,000.

(6) All direct laborers earn the same rate ($13/hour).During January,2,500 direct labor hours were worked.

(7) The predetermined overhead allocation rate is based on direct labor costs.Budgeted (expected)overhead for the year is $195,000 and budgeted (expected)direct labor is $390,000.

Write in the missing amounts (a)through (o)in the T-accounts above.

Definitions:

Customer Safety

Procedures, policies, and actions taken by a business to ensure the safety and well-being of its customers.

Capital Guidelines

Regulatory standards that determine the minimum amount of capital that banks and other financial institutions must hold, designed to ensure stability and manage risk.

Banking Regulators

Authorities or bodies that supervise and oversee the banking industry to ensure stability, consumer protection, and adherence to laws.

Noncomplying Banks

Banks that fail to adhere to specified regulations, standards, or laws set by banking regulators or supervisory authorities.

Q1: A company has an inventory turnover ratio

Q3: Which of the following is a disadvantage

Q24: The reporting of financing activities is identical

Q27: _ inventory consists of completed products ready

Q31: Dina Corp.uses a job order cost

Q55: A company uses a job order

Q64: Use the following information to calculate

Q85: After posting all actual factory overhead and

Q121: Describe the flow of labor costs in

Q137: Trend analysis is a form of horizontal