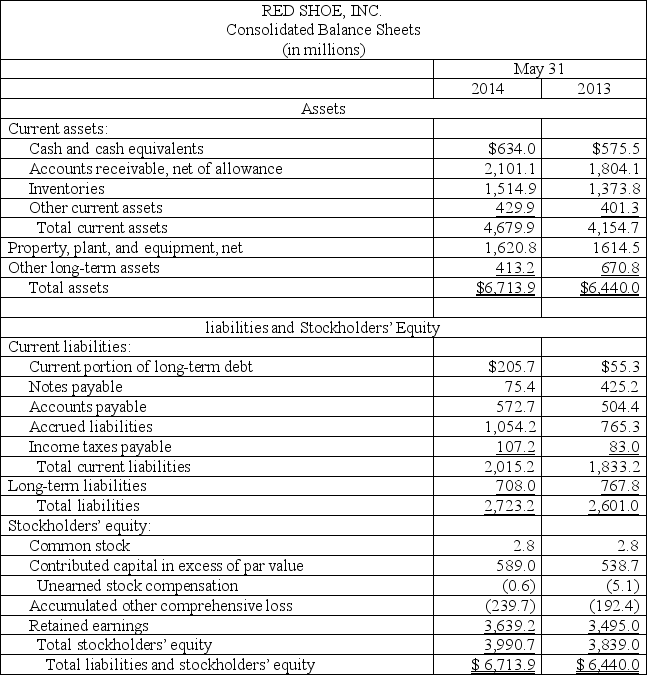

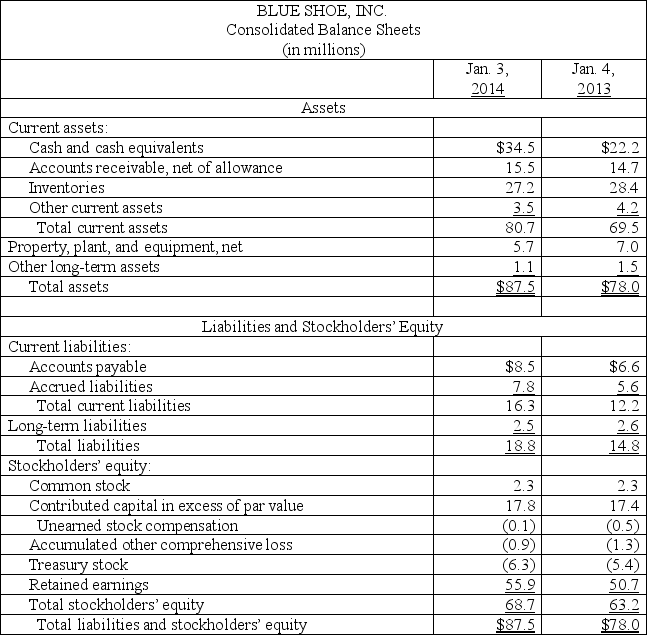

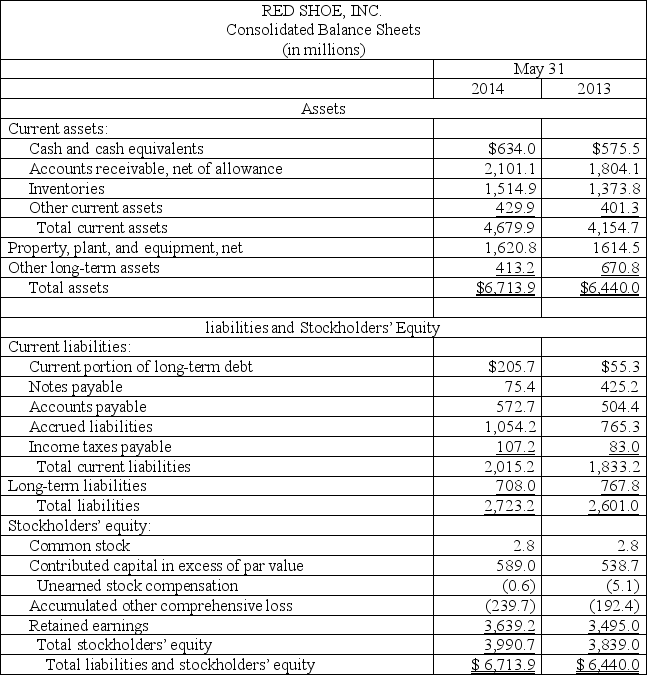

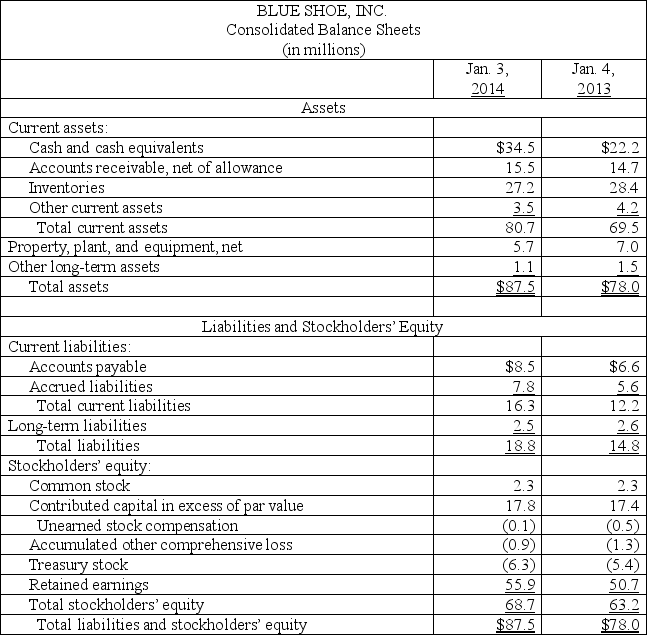

The following are summaries from the income statements and balance sheets of Red Shoe,Inc.and Blue Shoe,Inc.

RED SHOE, INC.Consolidated Statement of IncomeMay 31,2014(in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes Income before effect of accounting change Cumulative effect of accounting change, net of tax Net income $10,697.06,313.64,383.43,137.61,245.842.979.91,123.0382.9740.1266.1$474.0

BLUE SHOE, INC.Consolidated Statement of Income January 3, 2014(in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes Net income $133.587.346.237.38.9(0.1)0.39.13.9$5.2

(1)For both companies compute the following ratios for 2014:

(a)Current ratio

(b)Acid-test ratio

(c)Accounts receivable turnover

(d)Inventory turnover

(e)Days' sales in inventory

(f)Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2)For both companies compute the following ratios for 2014:

(a)Profit margin ratio

(b)Return on total assets

(c)Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Definitions:

West

A direction, region, or concept often associated with the western part of a country, continent, or the Western world, characterized by specific cultural, economic, or historical contexts.

Native Americans

Indigenous peoples of the Americas, present before the arrival of European settlers, with distinct cultures, languages, and histories, and who faced displacement and challenges to their way of life due to colonization.

Moral Suasion

The abolitionist strategy that sought to end slavery by persuading both slaveowners and complicit northerners that the institution was evil.

Moral Reform Groups

Organizations that emerged, particularly in the 19th century, with the goal of improving society by combating perceived moral failings, such as alcohol consumption, gambling, and prostitution.