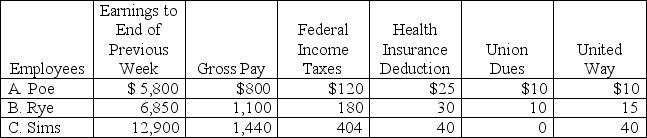

The payroll records of a company provided the following data for the currently weekly pay period ended March 7:

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Definitions:

Trial Court

The level of court where legal disputes are first presented and heard, including evidence presentation and witness testimony, to reach a verdict or decision.

Questions of Fact

Issues determined by a judge or jury in a trial regarding the truth or falsity of evidence presented.

Questions of Law

Issues concerning the interpretation or application of laws which are decided by a judge, as opposed to questions of fact, which are decided by a jury.

State Appellate Courts

Courts within a state's judicial system that review and rule on appeals from decisions of lower courts.

Q55: The Cash Over and Short account:<br>A) Is

Q65: What is a short-term note payable? Explain

Q75: An employee earned $4,300 working for an

Q82: A supplementary record created to maintain a

Q97: If a 60-day note receivable is dated

Q126: Holders of _ have a right to

Q140: Decision makers and other users of financial

Q145: The issue price of bonds is found

Q168: Identify and explain the different types and

Q195: January 2010,Giant Green Company pays $3,000,000