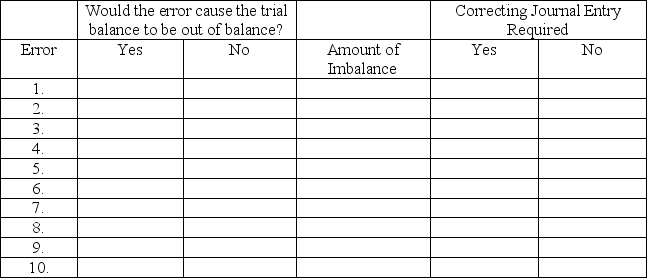

At year-end,Harris Cleaning Service noted the following errors in its trial balance:

1.It understated the total debits to the Cash account by $500 when computing the account

balance.

2.A credit sale for $311 was recorded as a credit to the revenue account,but the offsetting

debit was not posted.

3.A cash payment to a creditor for $2,600 was never recorded.

4.The $680 balance of the Prepaid Insurance account was listed in the credit column of the

trial balance.

5.A $24,900 truck purchase for cash was recorded as a $24,090 debit to Vehicles and a

$24,090 credit to Notes Payable.

6.A purchase of office supplies for $150 was recorded as a debit to Office Equipment.The

offsetting credit entry was correct.

7.An additional investment of $4,000 by Del Harris was recorded as a debit to Common

Stock and as a credit to Cash.

8.The cash payment of the $510 utility bill for December was recorded (but not paid)twice.

9.A revenue account balance of $79,817 was listed on the trial balance as $97,817.

10.A $1,000 cash dividend was recorded as a $100 debit to Dividends and $100 credit to cash.

Using the form below,indicate whether each error would cause the trial balance to be out of balance,the amount of any imbalance and whether a correcting journal entry is required.

Definitions:

Remorseful

Remorseful describes a feeling of deep regret or guilt for a wrong committed, reflecting a person's moral conscience and recognition of the impact of their actions.

Parent's Murder

The act of unlawfully killing one's mother or father.

Freud's Concept

Theories proposed by Sigmund Freud that emphasize the influence of the unconscious mind on behavior, including the structural model of the psyche composed of the id, ego, and superego.

Repression

A defense mechanism where distressing thoughts and memories are unconsciously kept out of consciousness.

Q7: The calendar year-end adjusted trial balance for

Q27: The heading on each financial statement lists

Q32: The purchase of supplies on credit should

Q39: FOB _ means ownership of goods transfers

Q52: A company paid $47,500 plus a broker's

Q142: The second step in the analyzing and

Q144: All companies desire a low return on

Q193: The primary objective of financial accounting is

Q204: Prepaid expenses,depreciation,accrued expenses,unearned revenues,and accrued revenues are

Q224: Which of the following does not require