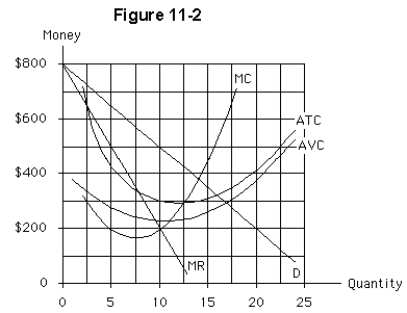

-Assume the firm in Figure 11-2 is currently producing 13 units of output and charging $380 each.The firm

Definitions:

Capital Gains

The profit from the sale of an asset or investment when the selling price exceeds the purchase price.

Non-Eligible Dividends

Dividends that are paid out by a company from earnings that are not subject to the preferential tax treatment as eligible dividends in some jurisdictions.

Average Tax Rate

The proportion of total taxable income that an individual or entity pays in taxes, calculated by dividing the total tax paid by the total taxable income.

Capital Gains

Capital gains are the profits realized from the sale of assets such as stocks, bonds, or real estate, which exceed the purchase price.

Q4: Diminishing marginal returns are the reason why

Q12: Wage rates in other markets are assumed

Q36: Which of the following will lower the

Q40: Both marginal revenue and marginal revenue product

Q51: If a good is excludable and nonrival,<br>A)

Q65: Wally's Wheat Farm sells its output and

Q65: The prisoner's dilemma demonstrates that<br>A) breaking out

Q112: Which of the following is an example

Q113: Which of the following must be true

Q166: If a firm is operating in a