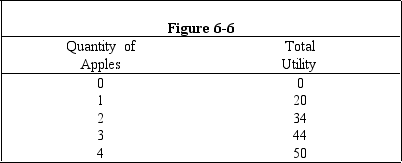

-Figure 6-6 shows the total utility that Jerry would receive from consuming several different quantities of apples per week.What can be said about Jerry's utility schedule for apples?

Definitions:

Distorting Tax

A tax that alters the economic behavior of individuals and businesses from what they would have chosen in the absence of the tax.

Economic Welfare

The overall well-being of individuals and societies, often assessed by factors such as wealth, health, and happiness.

Benefits-Received Principle

The concept that those who benefit from public goods and services should bear the costs of providing them, in proportion to the benefit received.

Progressive Income Tax

A tax system where the tax rate increases as the taxable amount increases, placing a higher burden on wealthier individuals.

Q8: For which of the following is demand

Q19: Suppose there are three buyers in the

Q56: When the price of gasoline is such

Q57: The demand curve facing a firm acts

Q83: Which of the following would cause a

Q95: Joe spends all of his money on

Q106: Which of the following goods is likely

Q150: Butter and margarine are examples of<br>A) substitutes<br>B)

Q181: If a perfectly competitive firm like the

Q184: If a supply curve shifts rightward along