REFERENCE: Ref.09_04 on December 1,2007,Keenan Company,a U.S.firm,sold Merchandise to Velez Company of Company

REFERENCE: Ref.09_04

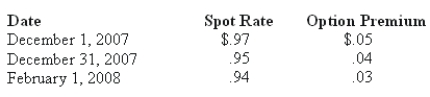

On December 1,2007,Keenan Company,a U.S.firm,sold merchandise to Velez Company of Spain for 150,000 euro.Payment is due on February 1,2008.Keenan entered into a forward exchange contract on December 1,2007,to deliver 150,000 euro on February 1,2008 for $.97.Keenan chose to use a foreign currency option to hedge this foreign currency asset designated as a cash flow hedge.Relevant exchange rates follow:

-Compute the value of the foreign currency option at December 31,2007.

Definitions:

Earnings Multiple

A valuation metric that shows how much investors are willing to pay for one dollar of earnings; commonly used in the P/E (price-to-earnings) ratio.

Extraordinary Item

Transactions and events that are both unusual and infrequent in nature, distinctly separate from the ordinary activities of the company, often excluded from the assessment of its ongoing operational performance.

Transitory Earnings

Earnings that are considered to be non-recurring or not indicative of the company's future earning potential.

Permanent Earnings

Profits generated by a company that are expected to continue in the future, excluding one-time events or transactions.

Q5: High-income people will sometimes pay higher prices

Q6: Which of the following could explain the

Q14: Economic models are used primarily to<br>A) predict

Q31: Which operating segments are separately reportable under

Q55: How should contingencies be reported in an

Q60: The question of scarce resources and unlimited

Q70: The knowledge that students gain while in

Q79: How is goodwill amortized for income tax

Q113: If Chris can produce a service using

Q137: Which production possibilities frontier(s)in Figure 2-4 depict(s)a