REFERENCE: Ref.09_04 on December 1,2007,Keenan Company,a U.S.firm,sold Merchandise to Velez Company of Company

REFERENCE: Ref.09_04

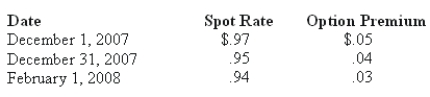

On December 1,2007,Keenan Company,a U.S.firm,sold merchandise to Velez Company of Spain for 150,000 euro.Payment is due on February 1,2008.Keenan entered into a forward exchange contract on December 1,2007,to deliver 150,000 euro on February 1,2008 for $.97.Keenan chose to use a foreign currency option to hedge this foreign currency asset designated as a cash flow hedge.Relevant exchange rates follow:

-Compute the value of the foreign currency option at February 1,2008.

Definitions:

Q1: Webb Co.acquired 100% of Rand Inc.on January

Q34: Justings Co.owned 80% of Evana Corp.During 2009,Justings

Q52: In a market system,resources are allocated by<br>A)

Q72: Which of the following statements is false

Q77: Which of the following is not an

Q84: All of the following are examples of

Q90: A physician's knowledge and skills are referred

Q95: The basic problem of economics arises when

Q116: Figure 2-1 illustrates the trade-off for a

Q118: The distinction between positive and normative economics<br>A)