REFERENCE: Ref.09_05 On April 1,2007,Shannon Company,a U.S.company,borrowed 100,000 Euros from a Foreign

REFERENCE: Ref.09_05

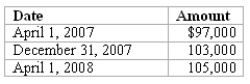

On April 1,2007,Shannon Company,a U.S.company,borrowed 100,000 euros from a foreign lender by signing an interest-bearing note due April 1,2008.The dollar value of the loan was as follows:

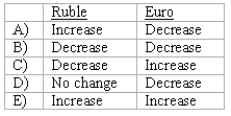

-Frankfurter Company,a U.S.company,had a ruble receivable from exports to Russia and a euro payable resulting from imports from Italy.Frankfurter recorded foreign exchange loss related to both its ruble receivable and euro payable.Did the foreign currencies increase or decrease in dollar value from the date of the transaction to the settlement date?

Definitions:

Withholding Per Pay Period

The amount of income tax an employer deducts from each paycheck, sent to the IRS on the employee's behalf, impacting the amount of potential refund or tax due.

Payroll Taxes Deposits

Payments made by employers to the IRS or other tax authorities for taxes withheld from employees' wages, including Social Security and Medicare taxes.

Lookback Period

The lookback period is a defined timeframe in the past during which certain events or transactions are reviewed for tax or regulatory compliance purposes.

TIN

Taxpayer Identification Number; a unique identifier assigned by the Internal Revenue Service or Social Security Administration to track taxpayers and accounts.

Q19: A shift in the production possibilities frontier

Q24: Blanton Corporation is comprised of five operating

Q39: Parent Corporation acquired some of its subsidiary's

Q78: Which of the following markets is more

Q89: A statement of opinion about which model

Q93: An economy is said to be saving

Q156: The opportunity cost of any action is<br>A)

Q160: Positive economic statements are usually easier to

Q166: The statement that "IBM's stock closed at

Q170: Understanding the distinction between positive and normative