REFERENCE: Ref.09_07 Winston Corp. ,A U.S.company,had the Following Foreign Currency Transactions During

REFERENCE: Ref.09_07

Winston Corp. ,a U.S.company,had the following foreign currency transactions during 2008:

(1. ) Purchased merchandise from a foreign supplier on July 16,2008 for the U.S.dollar equivalent of $47,000 and paid the invoice on August 3,2008 at the U.S.dollar equivalent of $54,000.

(2. ) On October 15,2008 borrowed the U.S.dollar equivalent of $315,000 evidenced by a non-interest-bearing note payable in euros on October 15,2008.The U.S.dollar equivalent of the note amount was $295,000 on December 31,2008,and $299,000 on October 15,2009.

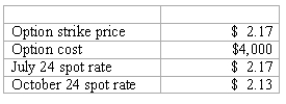

-Woolsey Corporation,a U.S.company,expects to order goods from a British supplier at a price of 250,000 pounds,with delivery and payment to be made on October 24.On July 24,Woolsey purchased a three-month call option for 250,000 British pounds and designated this option as a cash flow hedge of a forecasted foreign currency transaction.The following exchange rates apply:

What amount will Woolsey include as an option expense in net income during the period July 24 to October 24?

Definitions:

Parasympathetic

Refers to the part of the autonomic nervous system responsible for relaxation, conservation of energy, and slowing down bodily functions.

Sympathetic

Pertaining to the sympathetic nervous system, part of the autonomic nervous system responsible for activating the body's fight-or-flight response.

Somatic

Relating to or affecting the body, distinct from the mind or emotions.

Nucleus Accumbens

A brain region involved in the reward circuit, associated with pleasure, reinforcement learning, addiction, and fear.

Q7: For each of the following situations (1

Q13: One explanation for the drop in the

Q38: Compute the noncontrolling interest in Smith at

Q46: How is the gain on an intercompany

Q61: What is the new percent ownership of

Q65: The accrual-based income of West Corp.is calculated

Q69: Alpha,Inc. ,a U.S.company,had a receivable from a

Q78: Productive inefficiency could arise from<br>A) a waste

Q91: Which tests must a company use to

Q116: Even if economic theory is based on