REFERENCE: Ref.09_08

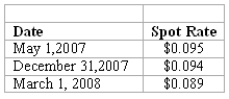

On May 1,2007,Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos.The machine was shipped and payment was received on March 1,2008.On May 1,2007,Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1,2008 at a price of $190,000.Mosby properly designates the option as a fair value hedge of the peso firm commitment.The option cost $3,000 and had a fair value of $3,200 on December 31,2007.The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12 percent,and the present value factor for two months at a 12 percent annual rate is .9803.

Mosby's incremental borrowing rate is 12 percent,and the present value factor for two months at a 12 percent annual rate is .9803.

-What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

Definitions:

Sedentary Lifestyle

A way of life that involves little to no physical activity, leading to potential health risks.

Breast Cancer

A type of cancer that develops from breast tissue.

Chemotherapy

A type of cancer treatment that uses drugs to destroy cancer cells, often by stopping the cancer cells’ ability to grow and divide.

Aerobic Fitness

A measure of the efficiency of the respiratory and circulatory systems in supplying oxygen to muscles during prolonged physical activity.

Q45: The production possibilities frontier illustrates<br>A) the combinations

Q49: If Smith's net income is $100,000 in

Q65: Compute the value of the foreign currency

Q66: All of the following would be examples

Q78: Which of the following markets is more

Q87: What was the net impact on Mosby's

Q100: Which of the segments are separately reportable?<br>A)DVDs

Q113: Which of the following best defines quantity

Q117: In the supply and demand for socks

Q147: The idea of opportunity cost suggests that