REFERENCE: Ref.09_09

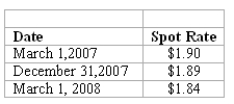

On March 1,2007,Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds.The machine was shipped and payment was received on March 1,2008.On March 1,2007,Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1,2008 at a price of $380,000.Mattie properly designates the option as a fair hedge of the pound firm commitment.The option cost $2,000 and had a fair value of $2,200 on December 31,2007.The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12 percent,and the present value factor for two months at a 12 percent annual rate is .9803.

Mattie's incremental borrowing rate is 12 percent,and the present value factor for two months at a 12 percent annual rate is .9803.

-What was the net impact on Mattie's 2008 income as a result of this fair value hedge of a firm commitment?

Definitions:

Scientific Theories

Well-substantiated explanations of some aspect of the natural world, based on a body of facts that have been repeatedly confirmed through observation and experiment.

Needlessly Complex

Describing a process, system, or item that is made more complicated than necessary, often leading to confusion or inefficiency.

Complex Phenomena

Events or situations that are multifaceted and difficult to understand due to the involvement of multiple interconnected factors.

Natural Scientists

Professionals who study the natural world using empirical evidence and scientific methods.

Q2: The rapid rise in oil prices during

Q6: Compute income from Stark reported on Parker's

Q7: Which of the following is not one

Q46: Assume that the publishing industry produces novels

Q48: Economists disagree about whether increasing the minimum

Q54: Larson Company,a U.S.company,has an India rupee account

Q61: According to the revenues test,which segment(s)are separately

Q102: Compute White's deferred income taxes for 2009.<br>A)$6,000.<br>B)$2,250.<br>C)$3,150.<br>D)$11,250.<br>E)$21,000.

Q121: Bread and butter are complements.A decrease in

Q153: Which of the following would be strictly