REFERENCE: Ref.09_10 on October 1,2007,Eagle Company Forecasts the Purchase of Inventory from Inventory

REFERENCE: Ref.09_10

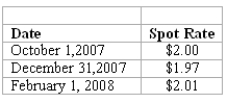

On October 1,2007,Eagle Company forecasts the purchase of inventory from a British supplier on February 1,2008,at a price of 100,000 British pounds.On October 1,2007,Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound.The option is considered to be a cash flow hedge of a forecasted foreign currency transaction.On December 31,2007,the option has a fair value of $1,600.The following spot exchange rates apply:

-What is the amount of Cost of Goods Sold for 2008 as a result of these transactions?

Definitions:

Assessment Methods

Techniques and tools used to evaluate, measure, and document the readiness, learning progress, skill acquisition, or educational needs of students.

Experimental Psychology

A branch of psychology that studies the mind and behavior through controlled experiments and systematic observation.

Single Subject

A research design focusing on the detailed examination of a single case or subject, often used in clinical psychology.

Operant Conditioning

A method of learning that uses rewards and punishments to influence behavior, introduced by B.F. Skinner, emphasizing the role of reinforcement and consequences.

Q5: The accrual-based income of Jade Co.is calculated

Q34: How is the amount of excess acquisition-date

Q38: Polar sold a building to Icecap on

Q44: Flintstone Inc.acquired all of Rubble Co.on January

Q44: What is the dollar amount of non-controlling

Q49: Defining a market involves deciding how to

Q56: What consolidation entry would have been recorded

Q100: Which of the segments are separately reportable?<br>A)DVDs

Q126: The principle of comparative advantage says that<br>A)

Q183: "Supply curves are upward sloping" is a