REFERENCE: Ref.09_10 on October 1,2007,Eagle Company Forecasts the Purchase of Inventory from Inventory

REFERENCE: Ref.09_10

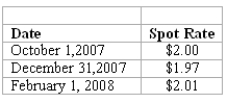

On October 1,2007,Eagle Company forecasts the purchase of inventory from a British supplier on February 1,2008,at a price of 100,000 British pounds.On October 1,2007,Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound.The option is considered to be a cash flow hedge of a forecasted foreign currency transaction.On December 31,2007,the option has a fair value of $1,600.The following spot exchange rates apply:

-What is the 2008 effect on net income as a result of these transactions?

Definitions:

Least Squares

A mathematical method used to find the best-fitting line through a set of points by minimizing the sum of the squares of the distances from the points to the line.

Regression Line

A straight line that best fits the data points on a scatter plot, showing the relationship between two variables.

Models

Replicas or systems that represent, simulate, or describe complex phenomena for the purpose of analysis or prediction.

Q7: All the problems studied in economics arise

Q15: Compute Collins' share of Smeder's net income

Q40: Evanston Co.owned 60% of Montgomery Corp.Montgomery owned

Q44: What is the dollar amount of non-controlling

Q64: Prepare the asset test to determine which

Q76: Which of the following would most likely

Q78: Productive inefficiency could arise from<br>A) a waste

Q95: An increase in the price of gasoline

Q103: According to the information in Figure 2-11,Jill's

Q142: The economic behavior of government is constrained