REFERENCE: Ref.09_12 on November 10,2008,King Co.sold Inventory to a Customer in a in a Foreign

REFERENCE: Ref.09_12

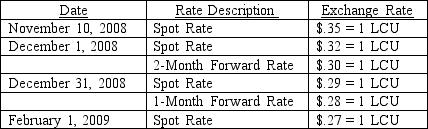

On November 10,2008,King Co.sold inventory to a customer in a foreign country.King agreed to accept 96,000 local currency units (LCU)in full payment for this inventory.Payment was to be made on February 1,2009.On December 1,2008,King entered into a forward exchange contract wherein 96,000 LCU would be delivered to a currency broker in two months.The two month forward exchange rate on that date was 1 LCU = $.30.The spot rates and forward rates on various dates were as follows:

The company's borrowing rate is 12%.The present value factor for one month is .9901.

The company's borrowing rate is 12%.The present value factor for one month is .9901.

-(A. )Assume this hedge is designated as a cash flow hedge.Prepare the journal entries relating to the transaction and the forward contract.

(B. )Compute the effect on 2008 net income.

(C. )Compute the effect on 2009 net income.

Definitions:

Demand Increase

A situation where the quantity of a product or service that consumers are willing and able to buy at a given price rises.

Price Elasticity

The sensitivity measure of demand for a good relative to its price changes.

Demand Curve

It illustrates the relationship between the price of a good or service and the quantity demanded for a given period, assuming all other factors are constant (ceteris paribus).

Midpoint Method

A technique used in economics to calculate the elasticity of a variable, which averages the starting and ending values to minimize the bias in the elasticities calculated at different points.

Q17: Suppose that the country of Utopia produces

Q47: If the supply curve does not shift,an

Q61: According to the revenues test,which segment(s)are separately

Q69: What term is used to describe a

Q92: One of the concepts that is illustrated

Q98: Tax collections in the United States are

Q100: In a market economy,<br>A) the government primarily

Q100: An economic model is<br>A) a concrete representation

Q111: How are extraordinary gains reported in a

Q151: An increase in supply results in a(n)<br>A)