REFERENCE: Ref.09_04 on December 1,2007,Keenan Company,a U.S.firm,sold Merchandise to Velez Company of Company

REFERENCE: Ref.09_04

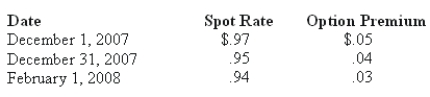

On December 1,2007,Keenan Company,a U.S.firm,sold merchandise to Velez Company of Spain for 150,000 euro.Payment is due on February 1,2008.Keenan entered into a forward exchange contract on December 1,2007,to deliver 150,000 euro on February 1,2008 for $.97.Keenan chose to use a foreign currency option to hedge this foreign currency asset designated as a cash flow hedge.Relevant exchange rates follow:

-Compute the value of the foreign currency option at February 1,2008.

Definitions:

Essay Exam

A type of test where individuals are required to write comprehensive and detailed responses to questions or prompts.

Free Recall

A test of memory in which an individual is asked to remember information without explicit prompts or cues.

Nonsense Syllables

A set of letters that do not form a known word, used in psychological experiments to study memory and learning processes by eliminating association effects.

Proactive Interference

The phenomenon where older memories interfere with the recall of newer memories.

Q40: According to SFAS 131,which of the following

Q44: Yelton Co.just sold inventory for 80,000 lira,which

Q49: Vapor Corporation has a fan products operating

Q56: What is meant by the spot rate?

Q63: What amount of foreign exchange gain or

Q70: What is the controlling interest share of

Q101: How do upstream and downstream inventory transfers

Q106: Figure 2-1 illustrates the trade-off for a

Q121: According to the law of increasing opportunity

Q157: Individuals face opportunity costs because<br>A) the minimum