REFERENCE: Ref.09_10 on October 1,2007,Eagle Company Forecasts the Purchase of Inventory from Inventory

REFERENCE: Ref.09_10

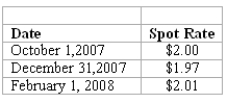

On October 1,2007,Eagle Company forecasts the purchase of inventory from a British supplier on February 1,2008,at a price of 100,000 British pounds.On October 1,2007,Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound.The option is considered to be a cash flow hedge of a forecasted foreign currency transaction.On December 31,2007,the option has a fair value of $1,600.The following spot exchange rates apply:

-What is the 2008 effect on net income as a result of these transactions?

Definitions:

FIFO Method

An inventory valuation method (First In, First Out) where the oldest items of inventory are recorded as sold first, with costs of the earliest goods purchased being the first to be recognized in determining cost of sales.

Inventory Valuation

The method or process of calculating the cost or value of inventory held by a business.

Common Stock

A type of security that represents ownership in a corporation, where shareholders are entitled to a portion of the company's profits through dividends and voting rights on corporate matters.

Asset Test

A liquidity ratio, also known as the quick ratio, measuring a company's ability to meet its short-term obligations with its most liquid assets.

Q2: The rapid rise in oil prices during

Q2: What is consolidated net income?<br>A)$229,500.<br>B)$237,000.<br>C)$245,000.<br>D)$232,500.<br>E)$240,000.

Q4: Net cash flow from financing activities was:<br>A)$(28,000).<br>B)$(35,000).<br>C)$(50,000).<br>D)$(63,000).<br>E)$(64,200).

Q44: Figure 2-1 illustrates the trade-off for a

Q64: What is the major assumption underlying the

Q70: How much Foreign Exchange Gain or Loss

Q72: Compute consolidated cost of goods sold.<br>A)$7,500,000.<br>B)$7,600,000.<br>C)$7,615,000.<br>D)$7,604,500.<br>E)$7,660,000.

Q94: What is the impact on the noncontrolling

Q111: Which of the following is not an

Q160: Positive economic statements are usually easier to