REFERENCE: Ref.08_10

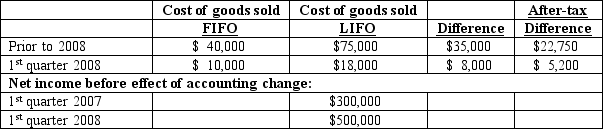

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2008.Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding.The following additional information is available:

-Assuming Baker makes the change in the first quarter of 2008,compute net income per common share.

Definitions:

Semi-Annually

Semi-annually refers to an event or action occurring twice a year, often used in the context of interest payments or reporting periods.

Yield To Maturity

The total return anticipated on a bond if the bond is held until its maturity date, factoring in its current price, interest payments, and maturity value.

Zero-Coupon Bond

A bond that does not pay periodic interest payments but is issued at a discount to its face value and redeemed for its full face value at maturity.

Purchase Price

The amount of money paid to acquire a good, service, or financial asset.

Q24: Combinations of goods outside the production possibilities

Q32: What is the adjusted book value of

Q33: What percentage of Tayle's income is attributed

Q38: All of the following statements regarding the

Q42: If the U.S.government decides to distribute surplus

Q43: What amount will Coyote Corp.report on its

Q51: Compute the noncontrolling interest in Gargiulo's net

Q82: How retail gasoline stations behave in a

Q86: Assume that U.S.agricultural land is used either

Q153: Which of the following would be strictly