REFERENCE: Ref.08_14 Harrison Company,Inc.began Operations on January 1,2008,and Applied the LIFO Method

REFERENCE: Ref.08_14

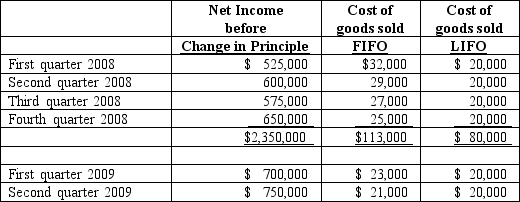

Harrison Company,Inc.began operations on January 1,2008,and applied the LIFO method for inventory valuation.On June 10,2009,Harrison adopted the FIFO method of accounting for inventory.Additional information is as follows:

The LIFO method was applied during the first quarter of 2009 and the FIFO method was applied during the second quarter of 2009 in computing income,above.Harrison's effective income tax rate is 40 percent.Harrison has 500,000 shares of common stock outstanding at all times.

The LIFO method was applied during the first quarter of 2009 and the FIFO method was applied during the second quarter of 2009 in computing income,above.Harrison's effective income tax rate is 40 percent.Harrison has 500,000 shares of common stock outstanding at all times.

-Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30,2008 and 2009.

Definitions:

Special Discounted Price

This is a temporary reduction in the selling price of goods or services, often used to attract customers or promote sales.

Segment Margin

The amount of profit or loss generated by one part of a business, after accounting for the direct and indirect costs of that segment.

Financial Advantage

The benefit gained in financial terms, which could be through savings, profits, or reduced costs.

Outside Supplier

An outside supplier is an external entity that provides goods or services to a company, not tied by corporate affiliation.

Q16: Prescott Corp.owned 90% of Bell Inc. ,while

Q19: A shift in the production possibilities frontier

Q21: An economic model<br>A) uses equations to understand

Q21: For what amount should Brisco's Accounts Payable

Q58: Dice Inc.owns 40% of the outstanding shares

Q63: Bauerly Co.owned 70% of the voting common

Q67: What adjustment is needed for Webb's investment

Q80: Under a socialist system,<br>A) most resources are

Q93: Due to a scarcity of resources,<br>A) governments

Q144: Which of the following is an example