REFERENCE: Ref.08_10

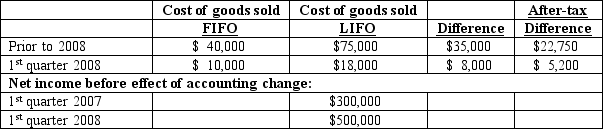

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2008.Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding.The following additional information is available:

-Assuming Baker makes the change in the first quarter of 2008,how much is reported as net income for the first quarter of 2008?

Definitions:

Supply

The total quantity of a good or service that the market can offer.

Demand

The amount of a product or service that consumers are willing and able to purchase at various prices during a specified period.

Equilibrium

A situation where the amount of goods available in the market matches what consumers want to buy, leading to stable prices and consistent availability.

Excess Supply

A situation where the quantity of goods or services supplied is greater than the quantity demanded at a given price.

Q11: What is the minimum amount of assets

Q14: The specialization of labor<br>A) leads to a

Q20: Gaw Produce Co.purchased inventory from a Japanese

Q33: Franklin Corporation owns 90 percent of the

Q51: Dog Corporation acquires all of Cat,Inc.for $400,000

Q55: Velway Corp.acquired Joker Inc.on January 1,2009.The parent

Q80: Dithers Inc.acquired all of the common stock

Q99: The Rivers Co.had four separate operating segments:

Q112: Using the indirect method,where does the decrease

Q122: According to the information in Figure 2-11,<br>A)