REFERENCE: Ref.08_10

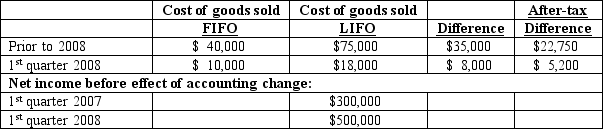

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2008.Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding.The following additional information is available:

-Assuming Baker makes the change in the first quarter of 2008,compute net income per common share.

Definitions:

5S

A workplace organization method originating from Japan that stands for Sort, Set in order, Shine, Standardize, and Sustain.

Lean Production

A manufacturing methodology that focuses on minimizing waste within manufacturing systems while simultaneously maximizing productivity.

Sort/Segregate

The process of separating items into different categories based on specific criteria to improve efficiency, organization, or processing.

Seven Wastes

Overproduction; queues; transportation; inventory; motion; overprocessing; defective product.

Q21: Explain how the treasury stock approach treats

Q47: For each of the following situations,select the

Q50: Which of the following will be included

Q51: Compute the U.S.dollars received on February 1,2008.<br>A)$138,000.<br>B)$136,500.<br>C)$145,500.<br>D)$141,000<br>E)$142,500.

Q64: Under market capitalism,resources are allocated primarily through<br>A)

Q79: A parent company owns a controlling interest

Q81: Stahl Corporation owns 80 percent of the

Q87: With regard to the intercompany sale,which of

Q93: Assume that Icecap sold inventory to Polar

Q109: How do intercompany sales of inventory affect