REFERENCE: Ref.07_08

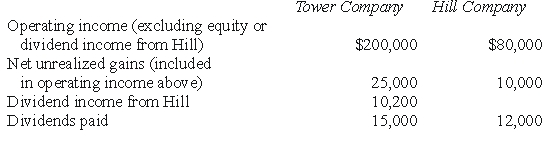

Tower Company owns 85% of Hill Company.The two companies engaged in several intercompany transactions.Each company's operating and dividend income for the current time period follow,as well as the effects of unrealized gains.No income tax accruals have been recognized within these totals.The tax rate for each company is 30%.

-How much income will be reported on the consolidated income statement before deducting noncontrolling interest?

Definitions:

Organizations

Entities where multiple people work together in a structured and coordinated manner to achieve a common goal or set of goals.

Lashley's Studies

Research conducted by Karl Lashley that sought to understand the relationship between brain structures and cognitive functions, notably in learning and memory.

Surgical Removal

The process of extracting or excising a body tissue, organ, or tumor through an operation, often to treat a medical condition.

Maze Learning

A method used in psychological experiments where an organism learns to navigate through a maze, often used to study spatial learning and memory.

Q4: Prescott Corp.owned 90% of Bell Inc. ,while

Q19: On January 1,2009,Race Corp.acquired 80% of the

Q33: What percentage of Tayle's income is attributed

Q61: Pear,Inc.owns 80 percent of Apple Corporation.During the

Q64: Assume the partial equity method is used.In

Q64: Under market capitalism,resources are allocated primarily through<br>A)

Q76: When consolidating a subsidiary under the equity

Q84: What amount of foreign exchange gain or

Q100: Describe how this transaction would affect Panton's

Q114: How are stock issuance costs and direct