REFERENCE: Ref.07_17 On January 1,2009,Maurice Co.acquired 75% of Lawrence Co.'s Outstanding Common

REFERENCE: Ref.07_17

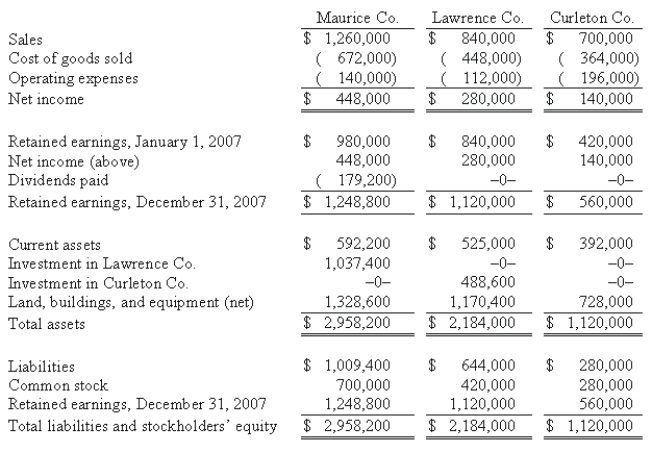

On January 1,2009,Maurice Co.acquired 75% of Lawrence Co.'s outstanding common stock.On the same date,Lawrence acquired an 80% interest in Curleton Co.Both of these investments were accounted using the initial value method.No dividends were distributed by either Lawrence or Curleton during 2009 or 2010.Maurice paid cash dividends each year equal to 40% of operating income.Reported operating income totals for 2009 were as follows:  Following are the 2010 financial statements for these three companies.Curleton made numerous transfers of inventory to Lawrence since the takeover: $112,000 (2009)and $140,000 (2010).These transactions included the same markup applicable to Curleton's outside sales.In each of these years,Lawrence carried 20% of this inventory into the succeeding year before disposing of it.

Following are the 2010 financial statements for these three companies.Curleton made numerous transfers of inventory to Lawrence since the takeover: $112,000 (2009)and $140,000 (2010).These transactions included the same markup applicable to Curleton's outside sales.In each of these years,Lawrence carried 20% of this inventory into the succeeding year before disposing of it.

An effective income tax rate of 45% was applicable to all companies.

I can't edit picture.Need to change the three years in the schedules - each from 2007 to 2010  The years should be 2010 instead of 2007 in this table

The years should be 2010 instead of 2007 in this table

-Required:

Determine the noncontrolling interest in Curleton Co.'s net income.

Definitions:

Variance

A statistical measure that represents the dispersion or spread of a set of data points or values around their mean.

Time-Cost Tradeoffs

In project management, the relationship between the time to complete a task and the cost associated with it, illustrating how increasing speed can lead to higher costs.

CPM Networks

CPM Networks, standing for Critical Path Method Networks, are project management tools used to schedule, organize, and coordinate tasks within a project.

Project Crashing

A project management technique used to reduce the project duration without altering the scope of the project, by adding resources to critical path tasks.

Q10: Economists disagree about many things.When those disagreements

Q12: Assuming this is a fair value hedge,prepare

Q14: Compute Cody's income tax expense for 2009.<br>A)$33,000.<br>B)$34,500.<br>C)$37,500.<br>D)$30,000.<br>E)$22,500.

Q30: Which of the following statements is true?<br>A)Pooling

Q44: What is the dollar amount of non-controlling

Q50: Compute the amount of Hurley's long-term liabilities

Q65: Suppose that the following headlines appeared in

Q76: Assume that Botkins acquired Volkerson as a

Q77: Keenan Company has had bonds payable of

Q113: Parent Corporation acquired some of its subsidiary's